japan corporate tax rate 2022

An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022. Combined Statutory Corporate Income Tax Rate.

The State Of Tax Justice 2021 Eutax

See the latest 2021 corporate tax trends.

. This Alert summarizes the key provisions relevant to. You can edit the rate as required. The Bill will be submitted to the Diet 1 and is expected to be enacted by the end of March 2021.

However this period may be shortened in the case that some significant tax matters were pointed out in the prior audit and so on. If prefectural and municipal income taxes are not withheld by the employer they are to be paid in quarterly installments during the following year. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes.

Pension Contributions This is the pensions rate defined for 2022 in the 2022 income tax rates and thresholds. A standard corporate income tax rate is 232 applies to the companies that operate in Japan with a share capital over JPY 100 million. Japan Corporate Tax Rate History.

Global tax rates 2022 is part of the suite of international tax resources provided by the Deloitte International. Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. Dollar sinks to one-month low.

Puerto Rico follows at 375 and Suriname at 36. A approximately 31 for large companies ie companies with a stated capital of more. On 10 December 2020 Japans coalition leading parties released the 2021 tax reform outline the Outline.

The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of JPY100000000 or less or 3062 for companies with paid-in capital greater than JPY100000000 including Japanese branch-offices of foreign companies with paid. Data is also available for. On the other hand the company collects 8.

Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. For example the 2021 taxes are paid in four installments in June August and October 2022 and January 2023. Is 2559 and the effective corporation tax rate national and local combined is.

Fifteen countries do not have a general corporate income tax. Historical corporate tax rate data. Japan Income Tax Tables in 2022.

The ruling coalition agreed on the Outline of the 2022 Tax Reform Proposals. KPMGs corporate tax rates table provides a view of corporate tax rates around the world. The current consolidated tax system will be abolished from the tax years beginning 1 April 2022.

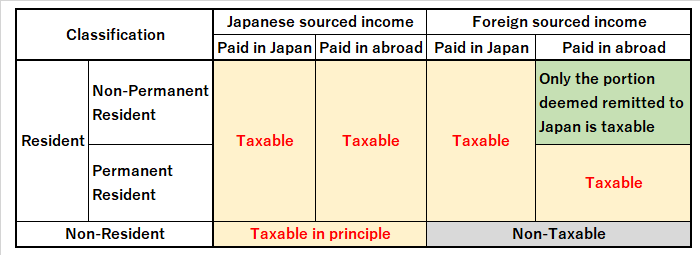

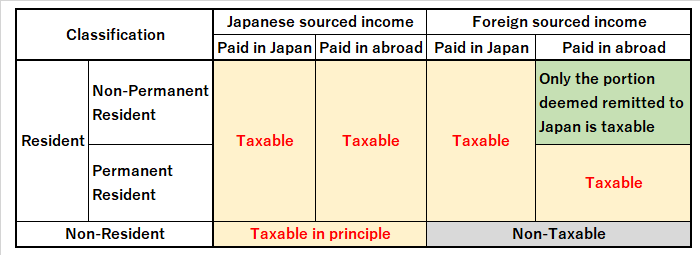

Personal exemption for Non-Residents. Corporate Tax Laws and Regulations Japan 2022. Personal exemption for Non-Permanent Residents.

Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021. The tax rate is determined based on the taxable income. We have set out in this KPMG Japan Tax Newsletter brief.

It is often registered in accounting in an account called prepaid consumption tax. The current rate has been raised from 8 to 10 on October 1st 2019. Principal business entities These are the joint stock company limited liability company partnership and branch of a foreign corporation.

Personal exemption for Permanent Residents. The ruling coalition agreed on the Outline of the 2022 Tax Reform Proposals on 10 December 2021. Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022.

ICLG - Corporate Tax Laws and Regulations - Japan Chapter covers common issues in corporate tax laws and regulations. The latest Personal Income Tax. A tax of 10 is paid on most of the purchases made by the company and this consumption tax paid on purchases can be claimed to the tax office.

It depends on companys scale location amount of taxable income rates of tax and the other. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy.

Will the Recent Inflation Signal a Rate Hike. Inhabitants tax local income tax. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by.

Income Tax Rates in Japan. New report compiles 2021 corporate tax rates around the world and compares corporate tax rates by country. Generally speaking corporate tax audit is performed in cycles of three to five years duration.

A tax reform bill the Bill will be prepared based on the Outline. 216 rows Comoros has the highest corporate tax rate globally of 50.

United Arab Emirates Corporate Tax Rate 2021 Data 2022 Forecast

Corporate Tax Reform In The Wake Of The Pandemic Itep

Capital Gains Tax Japan Property Central

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Tax Burden Soared Under Moon Administration

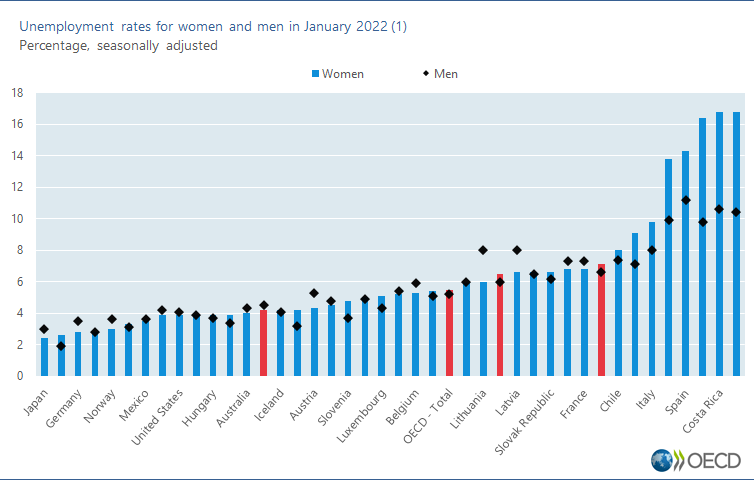

Unemployment Rates Oecd Updated March 2022 Oecd

Corporate Income Tax Cit Rates

Retirement Allowance Japan The Tax Rules Change

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Japan Monthly Inflation Rate February 2021 To February 2022 Statista

Corporate Tax Reform In The Wake Of The Pandemic Itep

2022 Corporate Tax Rates In Europe Tax Foundation

Corporation Tax Europe 2021 Statista

Corporate Tax 2022 Global Practice Guides Chambers And Partners